Maryland Real Estate News

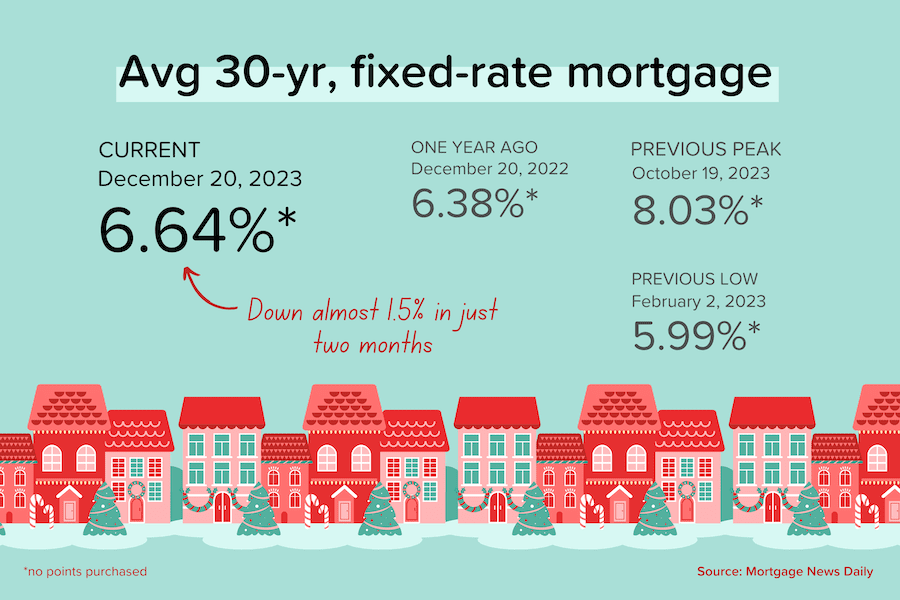

Maryland’s future seems bright under the latest economic projections. At just 1.6%, we currently have the lowest unemployment in the country! Inflation is slowing. The S&P is up. Mortgage rates are down significantly in the last week or so with the average being below 7% right now from a high of 8% or higher.

However, the housing market nationwide is lagging due to a lack of inventory. Inventory is 56% less than it was in 2019. This means less sellers are listing their homes for sale combined with the lack of new construction in the correct price points is forcing home prices to rise quickly. The effect is that the higher price point coupled with the high mortgage rates are creating a higher barrier to homeownership for buyers. Using the simple rule that housing costs should be no more than 30% of a household’s annual income, a home that sold in 2019 that would require a buyer to have $51,000 in annual salary now requires that same buyer to make $103,000 in order to afford the same home in 2023.

According to MD Realtors, Maryland ended the current calendar year approving the fewest new residential construction in any twelve-month period since July 2017 and, on a per capita basis, ranks 40th among all states. Simply put, Maryland is not building enough new houses to meet demand. Until they act on that, buyers will be less enthusiastic until mortgage rates drop.

National Real Estate News

Buyer activity has bottomed

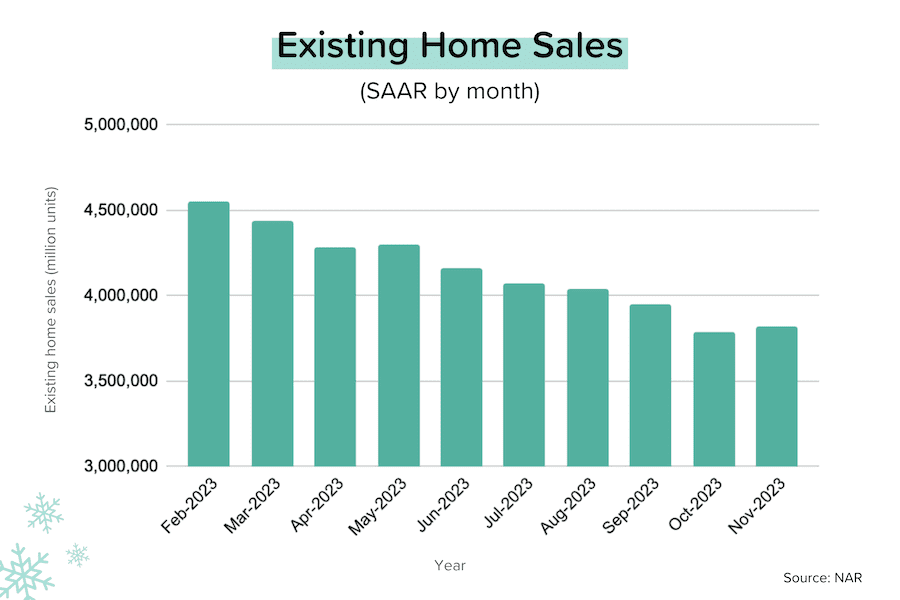

Existing (pre-owned) home sales broke a 5-month losing streak in November, rising nearly 1% month-over-month to an annualized rate of 3.82 million units. These sales only partially reflect the big drop in mortgage rates in the last two months, so we can expect even stronger numbers in the months to come. The median sales price in November was $388K, up 4% year-over-year. [Source: NAR]

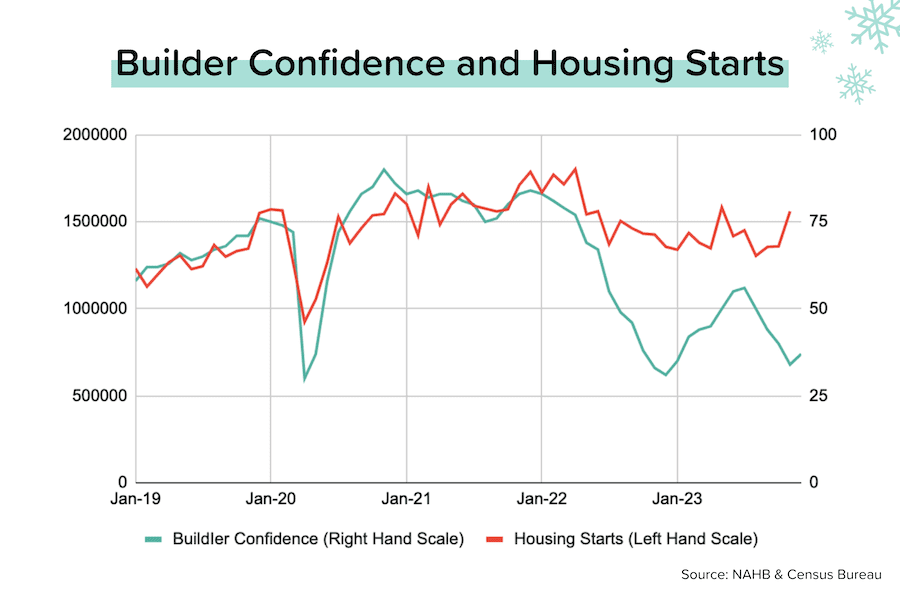

So has builder confidence

Throughout 2023, the low inventory of affordable, pre-owned homes for sale has pushed buyers towards new homes. But high mortgage rates have hurt new home demand too. With the recent fall in mortgage rates, buyer traffic and builder confidence is now recovering, and builders are ramping up construction of single family homes (73% of recent housing starts). [Source: NAHB & Census Bureau]

All about mortgage rates

In just two months, average 30-year mortgage rates have dropped nearly 1.5% to 6.64%. This is one of steepest falls in recent history. [Source: Mortgage News Daily] While rates are still double what they were back in 2021, the change is more important than the level when it comes to buyer sentiment. The drop in rates has shaved a few hundred dollars off the typical monthly mortgage bill.

Local Market Trends

As of Friday, December 29, 2023

| Area | Median Price | Active Listings | New Listings – 5 days | Median Days on Market |

|---|---|---|---|---|

| Baltimore, MD | $199,900  -0.2% -0.2% | 1707  -0.1% -0.1% | 134 | 51  0.2% 0.2% |

| Annapolis, MD | $592,500  -0.1% -0.1% | 136  0.1% 0.1% | 11 | 45  0% 0% |

| Crofton, MD | $415,000  -0.1% -0.1% | 14  -0.5% -0.5% | 1 | 32  -0.2% -0.2% |

| Ellicott City, MD | $724,525  0.1% 0.1% | 62  -0.1% -0.1% | 5 | 51  0.7% 0.7% |